When you buy

life insurance

, you are making an investment that you don't want to have to use, but that will protect your loved ones financially if you pass away while the policy is in force. There are many reasons for buying your first life insurance policy; maybe you had just gotten married, recently had or adopted a child, or bought a home. Whatever those reasons were, things can - and do - change over time. It's important to stay on top of your life insurance needs, making periodic adjustments as necessary to ensure your loved ones have the protection you want them to have.

These six life events may signal a need to change the amount and/or type of life insurance you have in place:

1. Buying a Home

When you buy a home, you're making a major investment in your future. If, like most people, you take out a mortgage to finance the purchase, you should consider purchasing

mortgage protection

life insurance. These types of insurance policies are designed so your loved ones wouldn't need to worry about how to continue making mortgage payments if you die prematurely. If your loved ones are dependent on your income, this protection can provide valuable peace of mind during a difficult time.

Similarly, if you've upgraded your home and your mortgage balance and payments have increased, it may be time to reevaluate your insurance protection.

2. Getting Married

When you get married or are in a committed relationship where your financial lives are intertwined, it's important to have enough life insurance to protect your spouse or partner in the event of your death. Life insurance provides a tax-free, cash death benefit that your loved one could use to continue their current standard of living, fund their retirement, pay for a child's education expenses, and more.

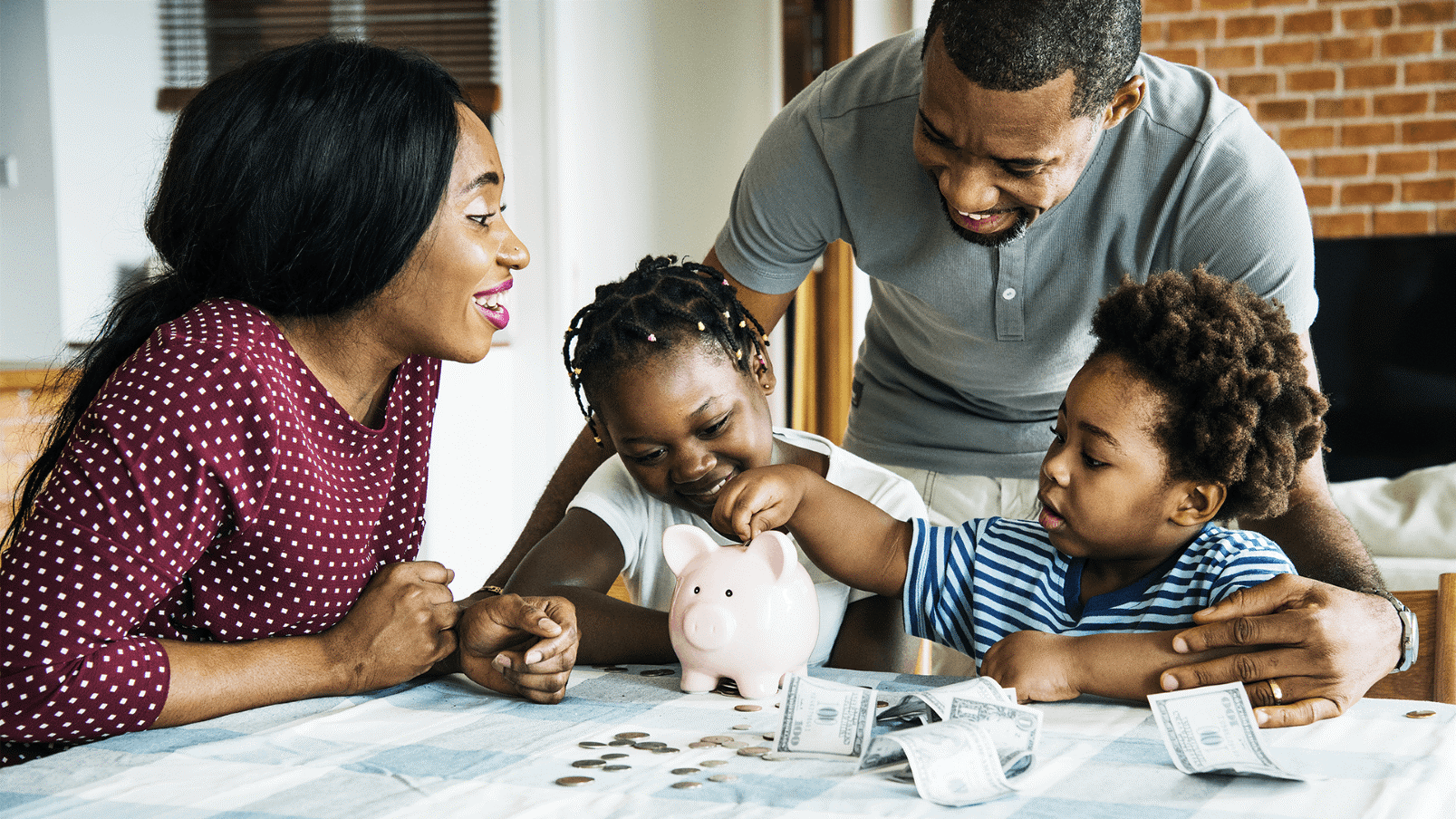

3. Having (or Adopting) a Child

Whenever your family grows, it's a good time to look at your life insurance protection needs and coverages. Life insurance death benefits could provide a safety net to pay for things like daycare and other child care expenses, as well as fund their college education if you're not there to do it yourself.

4. Getting Divorced

Just as getting married is a reason to look at your insurance needs, so is getting a divorce. At a minimum, getting divorced usually means you need to make changes to your named beneficiaries on your policy. You may also need to adjust the amount of coverage you have, especially if you have minor children.

5. Retirement Planning

As you plan for your future retirement, it's important to evaluate how life insurance can help you achieve your goals. Cash value life insurance products and annuities offer attractive ways to help you

save for retirement

while maintaining the other important protections life insurance products offer.

6. Estate Planning

Finally, life insurance is also an important component of estate planning. In addition to providing liquid funds that can be used to pay

final expenses

, life insurance can also be used for more advanced estate planning needs. Common uses include providing cash to pay estate taxes, creating a charitable legacy, providing financially for both a current spouse and for children from previous marriages, etc.

Symmetry Financial Group Can Help You Evaluate Your Needs

Fortunately, you are not on your own when it comes to determining if your life insurance needs have changed. Your

Symmetry Financial Group

independent insurance agent can help you identify your needs and what's most important to you from a risk protection standpoint, then evaluate your current coverage to identify whether it is still sufficient.

If your coverage needs have changed, your insurance professional will work with you to make changes that will protect your loved ones, within your budget. As a truly independent insurance provider, your Symmetry Financial Group agent has access to life insurance solutions from dozens of well-known insurance carriers, so he/she can find solutions that are tailored to you.

To learn more, call us at (877) 285-5402, or

contact us online

today.